Finding a Lender

Finding the right lender can make a big difference in your ability to get the best mortgage and loan terms that meet your needs, so shop around before deciding on one. If you don’t know where to begin this process, start by asking for referrals from your Lone Star Luxury Real Estate Agent, or your current bank. It’s also helpful to search online for trusted lenders and read their reviews. Here are a few tips to help you choose a lender.

You may be wondering, “What are loan terms?”. Loan terms are characteristics of your loan, such as what interest rate you’ll secure and how many years it will take to pay off your mortgage.

Finding a Lender

A mortgage lender is a financial institution that explains your financing options, underwrites your income and credit documentation, and approves your mortgage loan so you can purchase a home. Lenders work with you to ensure that you’ve completed all the required paperwork and they evaluate your credit history and financial health to determine whether you qualify for a loan and for what amount.

Lenders also provide explanations for the different options based on your financial qualifications. These options include interest rates, loan terms, and other loan details. Let’s go over what you’ll want to know before talking with a mortgage lender.

Many types of lenders can help your homebuying experience. Choosing one type of lender over another comes down to your needs and what you’re looking for in a lender.

Finding a Lender You Can Work With

- Online Lender Lead Service: Online sites display information about multiple Lenders and Brokers in one place

- Mortgage Broker: Mortgage Brokers work independently from the financial institutions that lend money. This approach allows them to work with multiple lenders who can help find you to find a variety of rates and loan products.

- Financial Institution: Consider speaking with a representative at your bank or credit union. Most major and local banks offer mortgage products and sometimes offer their current customers preferred rates or discounts.

- Non-bank Mortgage Lender: If your bank or credit union doesn’t offer mortgage products, or it doesn’t offer a competitive mortgage product that fits your needs, which is often the case, then a non-bank mortgage Lender is a better option since many companies specialize in only home financing. Your Lone Star Luxury Agent can give you some proven mortgage Lender options.

Why it’s Important To Shop Around

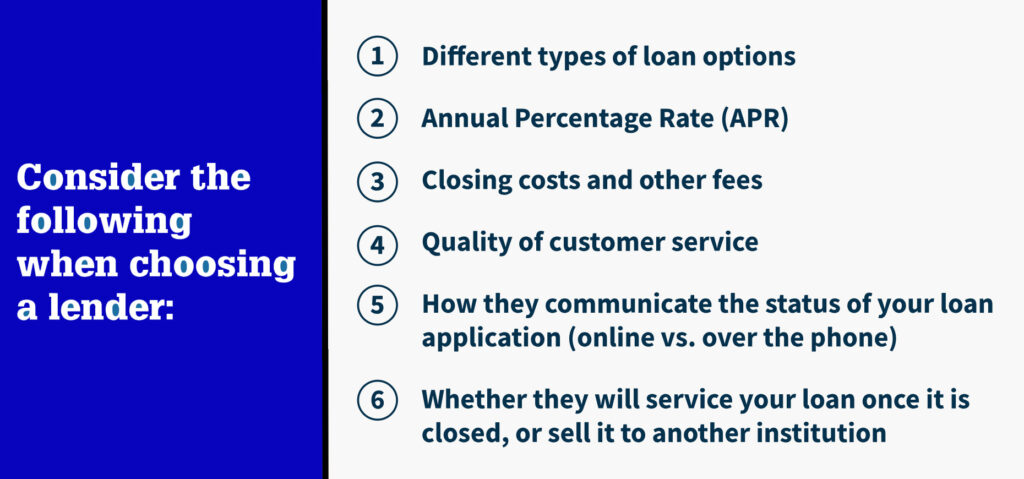

This could be the largest financial investment you’ll make, so be sure to speak with a few Lenders to find the best fit for your situation. You can start by searching for mortgage rates online. Then, reach out to Lenders to obtain a few quotes. You’ll want to compare costs and decide which ones meet your financial needs. While the interest rate you’ll pay is a big factor, it shouldn’t be the only factor. Let’s look at additional qualities that might help you choose the right lender for your needs.

Questions To Ask a Lender

When talking to different lenders, it’s a good idea to have questions prepared so you can make comparisons. Here are some questions you can ask to determine the right lender for you.

- What fees will I be responsible for at closing?

Closing fees are extremely important to know upfront—you’ll need to ensure that you’ve saved enough to cover these costs. It’s also an important factor when choosing a lender, as fees may vary. Be sure to obtain at least a few Loan Estimates to compare costs. - Will you waive any of these fees or roll them into my mortgage?

Again, this may determine what is owed upfront, your monthly payment amount, and the mortgage lender you choose. - How do you prefer to communicate with clients—email, text, phone calls—or in person?

If it’s easier for you to write everything down and read answers to questions, consider a lender who prefers email. Or, if you prefer to talk through things, you may choose a lender who prefers phone calls or meeting in person. While this is different for everyone, establishing your communication preferences upfront can make the mortgage process go more smoothly. - How long are your turnaround times on pre-approval, appraisal, and closing?

During the homebuying process, time is of the essence. If pre-approval takes a lot of time, this could delay looking at homes. If the appraisal has a long turnaround time, this can delay the purchase of the home and your closing date. It’s important not to rush, but it’s also important that a lender doesn’t slow you down. - Have you worked with the type of loan product that I need?

Knowing the type of loan you need and being familiar with requirements for that loan type can make the difference between a smooth or a bumpy loan process. For example, if you’re in the military or a veteran, you may want to ask about VA loans, which are mortgages backed by the Department of Veterans Affairs. If you live on an American Indian reservation, you may need a lender who specializes in loan products designed for tribal land trust. Some other loan products include FHA, USDA, Conventional, Jumbo and Reverse mortgages. Ask the lender what loan products they offer and work with on a regular basis. Make sure they are comfortable working with the loan products that are most appealing to you. - What are the down payment requirements?

You’ll want to know these requirements ahead of time so you can prepare. Also, these conditions may influence the lender you choose, especially if one lender has requirements that you can’t meet.

To help you in the process of finding a lender, use this guide (opens in a new tab)to keep track of lenders you talk to and jot down notes.

More First Time Home Buyer Info:

+ Rent or Buy.

+ Shopping with a Lone Star Luxury Agent.

+ Understanding Debt.

+ Credit Score.

+ Things To Consider Before Buying.

+ Understanding the Mortgage Loan Process.

+ Basic Types of Mortgage Loans and Terms.

+ Looking at Types of Homes.

+ Submit a Home Offer, Get an Inspection.

+ Closing your Loan.

+ Welcome to Homeownership.