Rent of Buy

Maybe you’re just starting to look for a place of your own and can’t decide if you should rent or buy. Or maybe you’ve been renting for a while and want to explore the possibility of buying a home, but you aren’t sure if you’re ready. While only you can decide the best option for yourself, it’s important to think about the pros and cons of each and see how those align with your priorities. This lesson covers things to consider when it comes to the big question, “Should I rent, or should I buy?”

Benefits of Renting

Renting is a great option if you don’t want to commit to one location because it provides more flexibility if and when you decide to relocate. Another benefit of renting is that maintenance and repair costs for things like a broken dishwasher or a running toilet are usually the rental management’s responsibility. Plus, renting gives you a chance to try out different types of living spaces and explore different neighborhoods to see what works best for you.

While renting is often thought of as more affordable than buying, this is not always the case. It may be a good option if you need some time to save up for a down payment and other costs associated with buying your own home; however, in some cases, your monthly mortgage payment can end up being less than your monthly rent.

Benefits of Buying/Owning

Buying might be a better option for you if you plan on staying in one location for several years. Homeownership gives you the opportunity to take pride in caring for the property you own. It allows you to build equity over the long term. Generally speaking, equity is the difference between your home value and the amount you own on the mortgage. Homeownership also has potential for tax advantages that don’t come with renting. One more benefit of buying: you can customize your space the way you like, from painting the rooms, to hanging curtains, to nailing a picture into the wall, without worrying about running it by your landlord or rental management company.

Track Your Finances

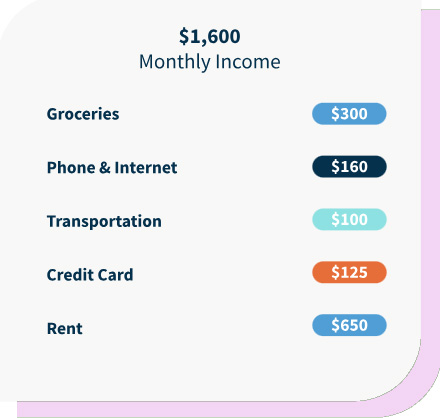

When considering whether to rent or buy, it’s important to see where your money is going. Keeping track of your expenses can give you a better idea of areas where you could cut back and tuck a little extra money away to save for a house. Keeping track of your finances is a great way to get a more accurate view of your financial situation.

Decide What’s Right for You

It’s important to do your research. If you decide that you’re not ready to buy, that’s ok. Be sure to reach out to a Lone Star Luxury Real Estate Agent who can help understand and prepare when the time is right. Even if you don’t have the funds for a down payment right now, there are FHA loans with only 3.5% down, VA loans for veterans with no money down, and USDA loans with no money down. We can also get seller to cover your closing costs! it’s never too soon to start thinking and saving, since homeownership could be an option in the near future if you are not ready now.

More First Time Home Buyer Info:

+ Shopping with a Lone Star Luxury Agent.

+ Finding a Lender.

+ Understanding Debt.

+ Credit Score.

+ Things To Consider Before Buying.

+ Understanding the Mortgage Loan Process.

+ Basic Types of Mortgage Loans and Terms.

+ Looking at Types of Homes.

+ Submit a Home Offer, Get an Inspection.

+ Closing your Loan.

+ Welcome to Homeownership.