Submit a Home Offer, Get an Inspection

Once we’ve found a home, the next step is to make an offer. Your Lone Star Luxury Real Estate Agent will take you through the process, the paperwork and will be the one who contacts the sellers or seller’s Agent to submit the offer.

When we submit an offer, it will most likely include on option period (inspections and unrestricted right to cancel), and earnest money, which you’ll learn about below . This money will be given to the Title Company if the buyer and the seller agree on terms, and both sign off on the contract, executing the agreement. This money will be applied toward your down payment or closing costs when the transaction is closed. Once an offer is accepted then we will finish the loan process, inspections, appraisal and other moves your Lone Star Luxury Agent will guide you through depending on the Loan type and Property type.

Submitting an Offer

By this time, you’ll have decided how much you are willing to pay for the home you want to buy. In some instances, you may want to put in an offer at a lower amount than the asking price. In other instances, you may want to consider offering more, depending on the demand for housing in your area and whether other offers have been made on the home. Rely on your personal comfort level as well as your Lone Star Luxury Agent’s expertise to help guide your decision. Let’s look at what goes into making an offer on a home.

The Role of Your Lone Star Luxury Agent in Submitting an Offer

As you consider making an offer, your Lone Star Luxury Agent will help you determine an amount, but in the end, the decision is yours. Your Agent will show you the prices of homes sold within the area and how high the demand is for them. If demand is high and multiple buyers show interest in the same home, your Agent may suggest that you add an escalation clause to your contract, which can increase your offer under the terms of the clause and may help you win a bidding war. If the home is in high demand, be ready to move quickly. Your Lone Star Luxury Agent may also suggest being flexible with parts of the process, such as the closing date.

What To Consider

- When you are ready to make an offer, don’t assume you have to offer your pre-approved or pre-qualified amount; you can offer less. (If you haven’t already, check out the Affordability Calculator (opens in a new tab).)

- Even if you submit an offer for less, make sure the final home purchase price is within your budget. The seller could either counteroffer or stand firm on the listed price.

- Make sure to avoid offers that are too low. It could cause you to lose the home you want.

- Consider if you want to negotiate payment of (or assistance with) closing costs.

- If you expect to make any renovations, you will want to factor in those future costs when you make your purchase offer. Think about:

– Do the windows need to be replaced?

– Is the HVAC system outdated?

– Does the house need a new roof? - You’ll also need to consider if your offer is contingent. This refers to the conditions that you’d want the seller to meet in order to move forward with the purchase of the home. This could include results from the home inspection, the appraisal, or your home loan getting approved.

Earnest Money

An earnest money deposit is a sum of money that you provide along with the offer to show how serious you are about buying the house. When multiple buyers make an offer on a home, sellers sometimes will go with the offer that has a higher deposit because they perceive these buyers to be more serious about buying the home.

Typically, earnest money deposits are between 1% and 3% of the price of the home, if there is little pressure than sometimes Earnest money can be lower than 1%. Your Lone Star Luxury Agent can help you determine an appropriate amount for your earnest money deposit based upon the circumstances around your offer. These deposits are held in an escrow account and then either applied toward the closing costs or your down payment at closing. Earnest money deposits are usually made through a personal check or wire transfer to the Title company. Be aware, if you back out of the sale for a reason not covered in the purchase agreement, then you may lose this deposit, depending on the terms in your sales contract. It is rare to lose earnest money but it does happen if a buyer backs out for a reason not covered in the Agreement. Your Agent will let you know the ins and outs of this.

Sales contracts can be structured to include an option period, and other due diligence periods. These periods allow for completion of a home inspection, reviewing the survey, HOA documents, other paperwork about the property, and an appraisal. If you back out during these periods, the earnest money is refundable.

Select a Title Company

Your Lone Star Luxury Agent or lender will help you select a title company to include in the offer . The title company will run a title search on the property to determine legal ownership, including any outstanding claims or liens on the property. Then, they’ll issue the title insurance for that property. If mortgage insurance is required as part of the terms of your loan, your lender will typically get this for you. As you learned in the Mortgage Loan Process, mortgage insurance protects the lender in case you stop paying your home loan. Your title company will also handle the distribution of money, so every party gets the funds they need to complete the sale.

Presenting the Offer

Once you’ve decided what your offer will be, you’ll work with your Lone Star Luxury Agent to submit the offer. Here’s an overview of the offer process.

Step 1: Sales Contract, aka Purchase Agreement

Your Lone Star Luxury Agent (the buyer’s agent) will prepare a sales contract that details the terms of the offer and present it to the seller’s Agent. The seller’s agent will most likely need proof of pre-qualification or a pre-approval letter at this time. Your agent talks to the seller’s Agent, who will then discuss the offer with the seller.

Step 2: Offer Terms

The seller will review the terms of your offer, as well as other potential offers, and assess the offer price to determine whether they accept, decline, or want to make a counteroffer. If they decide to counteroffer or negotiate, the next step begins.

Step 3: Negotiation

If the seller decides to negotiate, they will decide the price and terms they are comfortable proceeding with, and their Agent will these share details with your Agent. Note that the seller can decide to negotiate with several potential buyers at the same time; it is up to the seller to decide whether to share this information with prospective buyers.

This process may repeat itself until both you and the seller come to an agreement—to either find common ground or not. The offer is not binding until all parties sign it and it’s delivered to you, the buyer. Then, it becomes a ratified sales contract

After the Offer is accepted

Congratulations! At this point, the seller has accepted your offer, and you have a ratified sales contract. You now have control of the home and only failing to get the mortgage or backing out of the contract yourself is the only ways to lose the home. Soon you will be a new homeowner, but first you need to complete a few important items. Now it’s time to start putting some of the money that you saved to work and take the next steps to obtain a mortgage.

Ratified (Executed) Sales Contract

One of the conditions of getting your mortgage is to send your lender a ratified sales contract, aka executed sales contract. A ratified contract means that the terms have been agreed upon, each party has initialed or signed next to each other. Once signed by all parties, this ratified contract becomes a legally binding contract for both buyer and the seller. It should include a closing date and all agreed upon terms of the offer. Nothing should be a verbal agreement, it should all be written and included in the executed contract.

Home Inspection

A home inspection is a great way to discover the true health of the home you want to purchase. It can provide peace of mind as well as reveal any issues with the home that is not reflected on the Seller’s Disclosure and and any issues that you didn’t notice when viewing the home.

Why an Inspection Is Important

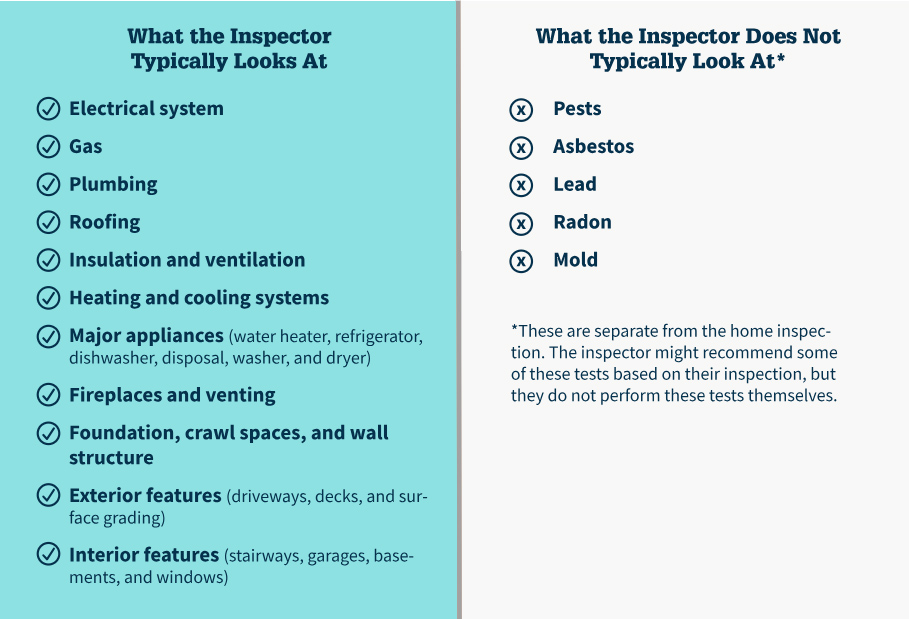

We always recommend a home inspection. A home inspection can help reveal the overall condition of the house by examining things like the roof, HVAC system, windows, doors, walls, plumbing, and electrical systems. Inspections may be able to identify safety issues, illegal installations, and other maintenance and structural issues that you would want to know about before buying the home. Depending on the severity of the inspection findings and/or repairs needed, you could either back out of your offer or negotiate how, when, and who will pay for the repairs.

The buyer usually pays for the home inspection. While it may be tempting to save a few hundred dollars and skip a home inspection, it could save you thousands of dollars if the inspection reveals hidden issues with the house.

The sales contract may include a home inspection contingency, known as an option period, or a due diligence period. This is a period of time in which you as the buyer can terminate the contract for any reason. You will typically have the home inspection done during the due diligence period.

Coordinating the Inspection

Although it is your responsibility and decision to schedule an inspection, Lone Star Luxury Agents have a list of reputable inspection companies to choose from and can help schedule this for you. It’s important to have the home inspection soon after the seller accepts your offer and to find a time for the inspection that works for all parties, including the seller, during your option period. Don’t wait for the last day of your option period.

Remember, the results of the inspection could impact the offer and subsequent sale of the home. You and your Agent will want to be at the property while the inspection takes place so that you can ask questions of the inspector along the way, but you don’t have to be there and the Inspector will provide a full report typically 24-48 hours after the inspection. The seller is usually asked to leave the home during this event.

During the Inspection

During the home inspection, if certain areas of the home concern you, make sure to point those out. You can also ask questions about general maintenance and care for various items. This is a great way to get to know your home.

Part of the inspection process is getting answers about the home’s structure and condition, so it’s important to ask questions. Here are a few examples of things to note:

- Where is the electrical panel? Is it labeled properly?

- Where are all the water shut-off valves located?

- If the home is on a septic waste system, where is the system located?

- Is there evidence of standing water? Is there water staining on the ceiling?

If you’re unsure about something you see or that your inspector says, make sure to ask for clarification. The inspection will also be one of the last times you’ll visit the home before your final walk through and purchase. It’s a great time to take photos and measurements for items like window blinds and furniture. To keep track of what you want an inspector to look at, download the home inspection checklist(opens in a new tab).

After the Inspection

After the home inspection, you’ll want to take your time going through the report with your Lone Star Luxury Agent. If you find problems, such as a roof that needs replacing, think about how you want to proceed. You might ask the seller to either make repairs before you move in or lower the purchase price so you can make repairs once you take ownership. If the seller does not want to negotiate, or the inspection reveals something that isn’t up to code or compromises the integrity of the home, you’ll want to determine if you’re prepared to either take care of these issues or walk away from the sale. This is a great time to ask your Agent for insights on what might be a deal breaker, what is not a big deal and what is worth negotiating.

If your inspection doesn’t reveal anything that compromises the integrity of the home or reveals only minimal issues, then the home purchase will continue to move forward.

Even if no major issues are revealed, the home inspection report is still a valuable document. You can use it as a reference for any minor repairs that you may need to budget for post-purchase. This could help you plan for any major repairs in the future, like major appliances, a new roof, etc.

Here are some helpful resources from this module, plus others which you’ll find useful during your homebuying journey.

Useful Resources:

Checklist: Home Loan Documents

This checklist can help make sure you are providing your lender with everything they will need to fulfill the loan process. VIEW CHECKLIST(OPENS IN A NEW TAB)

Checklist: Getting a Home Inspection

Use this checklist to keep track of what you want an inspector to look for. VIEW CHECKLIST(OPENS IN A NEW TAB)

International Association of Certified Home Inspectors®

This website includes a search option for finding a home inspector. VIEW RESOURCE(OPENS IN A NEW TAB)

Affordability Calculator

How much home can you afford? This calculator can help you estimate this based on factors like your income, debt, and how much you want to put down. VIEW CALCULATOR(OPENS IN A NEW TAB)

Homebuying Glossary

This glossary contains common terms often used in the homebuying process and their definitions. VIEW GLOSSARY(OPENS IN A NEW TAB)

Down Payment Assistance Resources

Use this website to find resources to help with your down payment. FIND RESOURCES

More First Time Home Buyer Info:

+ Rent or Buy.

+ Shopping with a Lone Star Luxury Agent.

+ Finding a Lender.

+ Understanding Debt.

+ Credit Score.

+ Things To Consider Before Buying.

+ Understanding the Mortgage Loan Process.

+ Basic Types of Mortgage Loans and Terms.

+ Looking at Types of Homes.

+ Closing your Loan.

+ Welcome to Homeownership.