Understanding Debt

Understanding debt can be tricky, but it’s important to learn how it works and what lenders consider when determining if you qualify for a mortgage loan. Keep in mind, while you may want to pay down debt before you apply for a home loan, you might not need to pay it all off. Let’s take a look at a few things that are important to understand about debt.

What Is the Debt-to-Income Ratio?

Basically, the debt-to-income ratio (DTI) is how much debt you have compared to your income. Just like credit scores help lenders determine how likely a borrower is to make payments on time, DTI helps lenders determine whether you’ll have trouble making monthly mortgage payments. Lenders view this as a key indicator of how well you manage money, and whether you can afford to take on more debt.

How DTI Impacts Qualifying for a Home Loan

Your DTI ratio will be a strong factor when determining how much you’ll be approved to borrow, your interest rate, and other loan terms. The lower your DTI, the better. In general, you will need a DTI of 50% or less to qualify for most loan programs. An even lower DTI can result in better interest rates and access to additional loan programs.

How To Calculate DTI

Now that you understand why DTI is important, let’s look at how you can calculate it yourself. You can figure out your DTI ratio by adding up your total monthly debt payments and then dividing that amount by your gross monthly income, which is the total monthly income before taxes and other deductions are made. Your monthly debt payments may include things like:

- Current or future monthly housing payments,

- Any student loans or car loans,

- Alimony and/or child support payments,

- Minimum credit card payments, or

- Any other fixed or revolving debt.

Note that monthly debt payments do not include bills for things like cell phone, car insurance, utilities, cable, child care, etc.

When you apply for a loan, the new monthly loan payment will become a factor when determining your total DTI vs. what you currently pay for housing/rent.

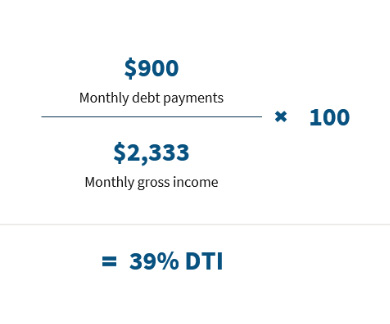

For example, let’s say that every month your total monthly debt payments are $900. Let’s say you make $28,000 a year, so your monthly gross income is $2,333 ($28,000 divided by 12 equals $2,333).

To calculate DTI, divide $900 by $2,333, which comes out to 0.39. Then multiply this by 100 to get your current DTI ratio of 39%.

Ways To Improve Your DTI

If your DTI ratio is high, you can improve it by trying a few things:

- Review your budget to find some extra money to put toward paying off your debt.

- Review your current credit report for an overview of all your debts and the payments associated with them.

- Avoid large purchases, especially if it adds to your debt. This can be hard, but the purchases you make while trying to qualify for a home loan may impact your approval status.

Give yourself time to lower your DTI or pay off debt. It won’t happen overnight.

If you want to better understand or are concerned about your DTI ratio, you may want to seek assistance from a lender, a housing counselor, or other educational resources if you need help in developing a plan to reduce your DTI.

More First Time Home Buyer Info:

+ Rent or Buy.

+ Shopping with a Lone Star Luxury Agent.

+ Finding a Lender.

+ Credit Score.

+ Things To Consider Before Buying.

+ Understanding the Mortgage Loan Process.

+ Basic Types of Mortgage Loans and Terms.

+ Looking at Types of Homes.

+ Submit a Home Offer, Get an Inspection.

+ Closing your Loan.

+ Welcome to Homeownership.